HÖRMANN Group adds VacuTec and Funkwerk to its investment portfolio

The technology specialist HÖRMANN Finance (corporate bond: ISIN DE000A1YCRD0) today resolved to expand its investment portfolio in the Engineering and Communication segments. This will be achieved through the acquisition of an additional equity interest of 52.85% in Funkwerk AG by HÖRMANN Funkwerk Holding GmbH including the netting of receivables, as well as a majority interest in VacuTec Messtechnik GmbH by way of a capital increase through contributions in kind. Following the conclusion of these non-cash transactions, which is expected by the end of this year, HÖRMANN Finance will hold 78.35% of the shares in Funkwerk AG and 90% of the shares in VacuTec Messtechnik GmbH. These measures will mean that all of the significant majority-owned operating companies of HÖRMANN Group will be bundled in HÖRMANN Finance, thereby optimising the Group structure as a whole.

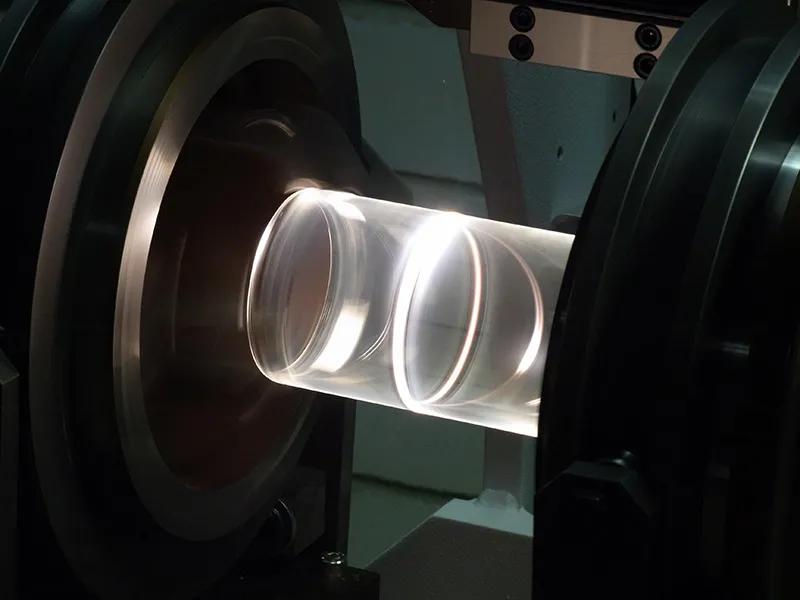

With these additions to its investment portfolio, HÖRMANN Finance is strengthening its Communication and Engineering divisions, two of the three mainstays of the company alongside the Automotive division. Funkwerk AG (ISIN DE0005753149), a listed company and leading provider of communication, information and security technology used especially in train radio and personal and building security systems, is being integrated into the Communication division. VacuTec Messtechnik GmbH, a highly profitable provider of radiation measuring systems for medical, industrial and environmental applications, is joining the Engineering division.

The acquisition of the majority interests in Funkwerk AG (pro forma sales in 2015: EUR 75.7 million; pro forma EBIT in 2015: EUR 4.8 million) and VacuTec Messtechnik GmbH (sales in 2015: EUR 9.2 million; EBIT in 2015: EUR 3.5 million) will lead to a significant increase in sales and an improvement in operating profitability at HÖRMANN Finance in future, without any debt having been taken on for the two transactions.

Johann Schmid-Davis, CFO of HÖRMANN Finance GmbH, commented, ‘By adding to our investment portfolio, we are further diversifying our business model with three distinctly profitable divisions. With ongoing investment, we will continue to build on our good technological position, boost our competitiveness and adopt a more international set-up in the future as well.’